Protection from accelerating drug costs is finally coming to people on Medicare thanks to the Inflation Reduction Act, signed into law by President Biden earlier this year.

The biggest changes for 2023? Vaccinations will be free, including the shingles vaccine, and insulin won’t cost more than $35 a month. The new law also keeps the lid on other medication costs because drugmakers will be penalized for price hikes that are more than the rate of inflation.

Another huge benefit—a $2,000 annual out-of-pocket cap for medications—doesn’t begin until 2025. (In 2024 the cap will be $3,500.)

Meanwhile, to really save at the pharmacy, there are still important steps to take during Medicare open enrollment, which runs from Nov. 15 through Dec. 7. A major one is to decide which pharmacy drug benefit (Part D) plan to choose, or if you’re already signed up for a drug plan, whether to re-enroll for next year or shop for a new one. Because much can change from year to year, the switch-or-stay decision isn’t as straightforward as it might seem.

More on Healthcare Costs

Could Medical Bills Make You Sick?

The Pros and Cons of Medicare Advantage

When Your Insurer Drops Your Prescription Drug

Ban on Surprise Medical Bills Helps Consumers

For one thing, deductibles and monthly premium charges can go up. For another, the drugs a plan covers—and how well it covers them—can also be different, says Frederic Riccardi, president of the Medicare Rights Center, a nonprofit group that counsels people on finding Medicare plans and advocates for pro-consumer Medicare policies.

The process of finding an affordable plan that partners with local pharmacies can be tedious and challenging. It involves entering all of your drug information into the Medicare.gov tool, identifying pharmacies near you, then comparing plan details, such as the monthly premium and deductible.

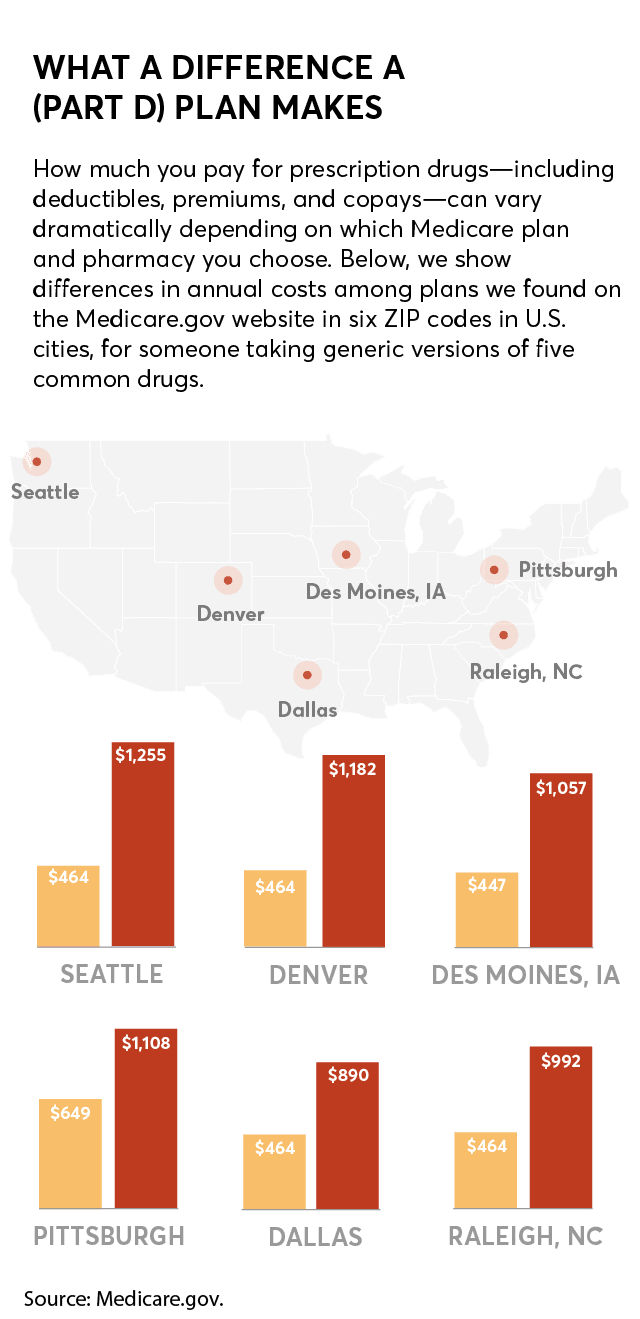

But taking the time to shop thoroughly can save you hundreds—and potentially even thousands—of dollars, according to a shopping analysis by Consumer Reports done in late 2021 but still broadly meaningful. We evaluated several low-cost Medicare Part D plans at pharmacies in six ZIP codes across the U.S. using a market basket of five common generic drugs: pioglitazone (brand name Actos) for diabetes; celecoxib (Celebrex) for joint pain; duloxetine (Cymbalta) for depression; atorvastatin (Lipitor) for cholesterol; and clopidogrel (Plavix) for blood clots.

Even if you don’t take any medications, you shouldn’t skip signing up for a plan, says Stacie Dusetzina, PhD, an associate professor of health policy and a drug cost expert at Vanderbilt University in Nashville, Tenn. That’s because Medicare imposes a penalty—1percent per month added to the Part D premium—if you don’t sign up when you turn 65.

“Eventually, you’ll probably need medication, so you’ll want to be covered,” Dusetzina says. The best solution in this circ*mstance, she says, is to sign up for a plan with a low or no-cost premium.

For those who do take medications and need to renew for next year, consider these steps as you go through the Medicare Part D sign-up process.

Enter All Your Meds

Start by adding all the medications you take into the Medicare.gov tool (choose the Find Health and Drug Plans tab at the top), including the dosages, quantity, and frequency. Your goal is to find a plan that covers all or as many of your meds as possible, says Dianne Savastano, founder of Healthassist, a healthcare consulting firm for consumers.

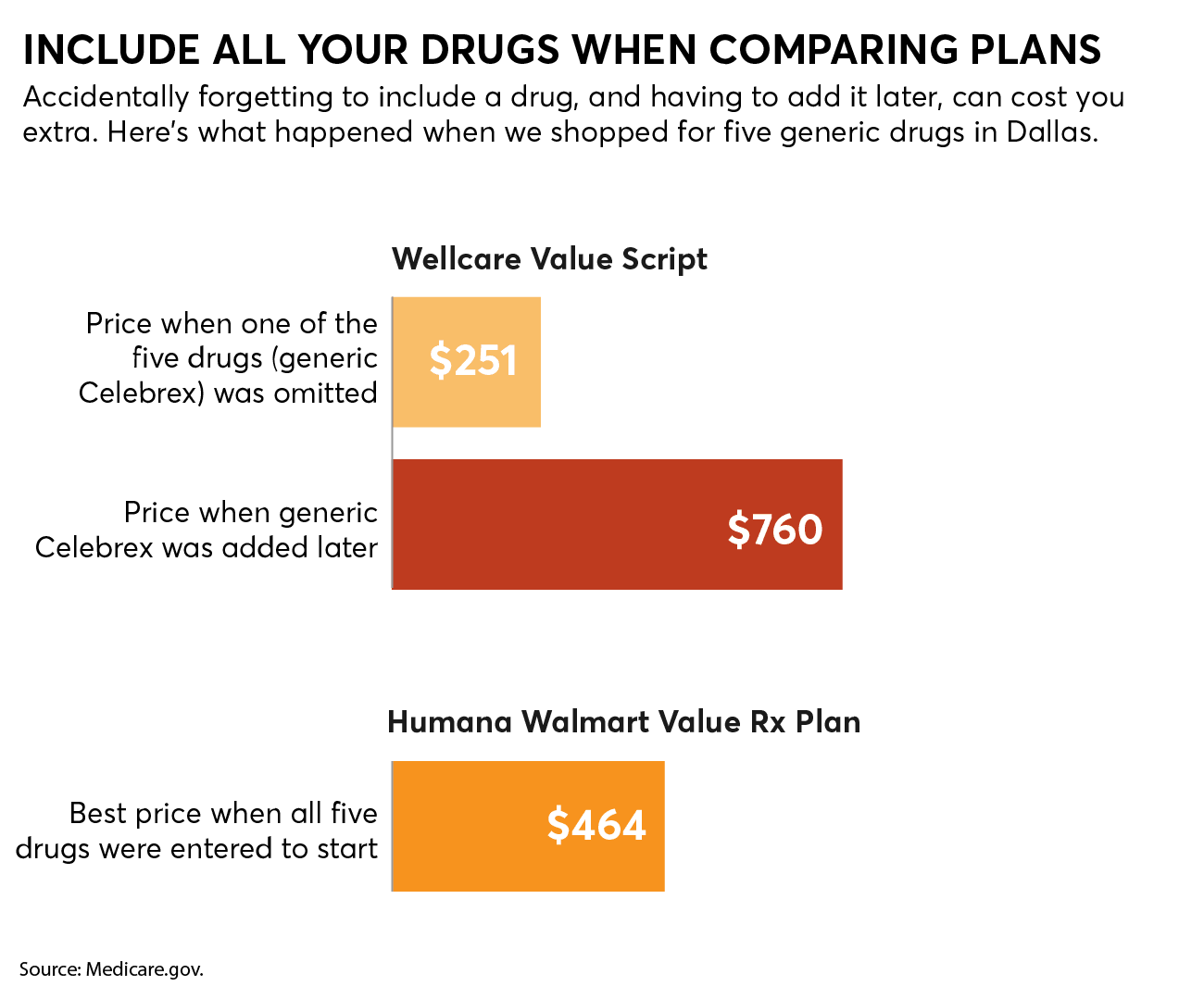

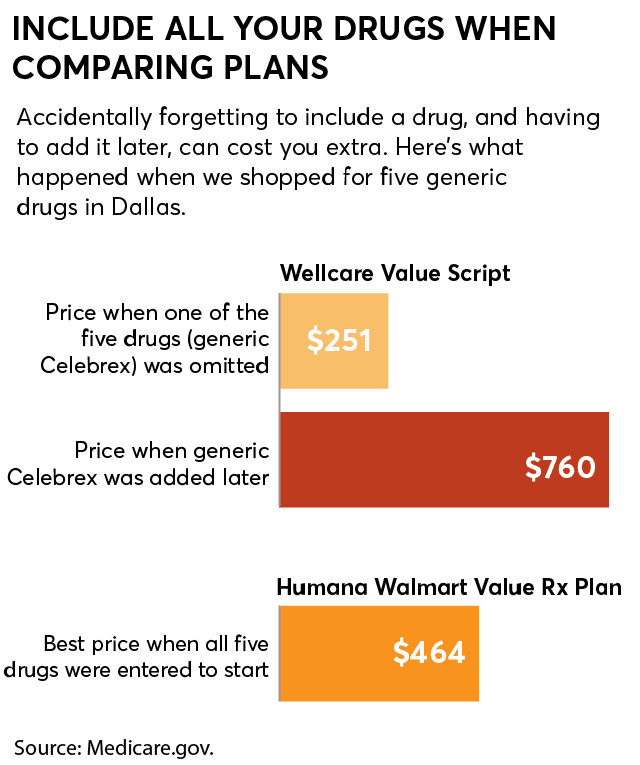

Leaving one of your meds off the list can cost you hundreds of dollars. For example, for the pharmacies we selected in our 2021 analysis, when we left off the generic version of Celebrex in Dallas, a plan called Wellcare Value Script was the least expensive, coming in at $250.80 for the year, including premiums, at a preferred pharmacy. But had we included that drug, the same Wellcare plan would have cost $759.60, while a different plan, Humana Walmart Value Rx Plan, would have been the cheapest, at just $463.56 through a preferred pharmacy.

Do a Thorough Pharmacy Search

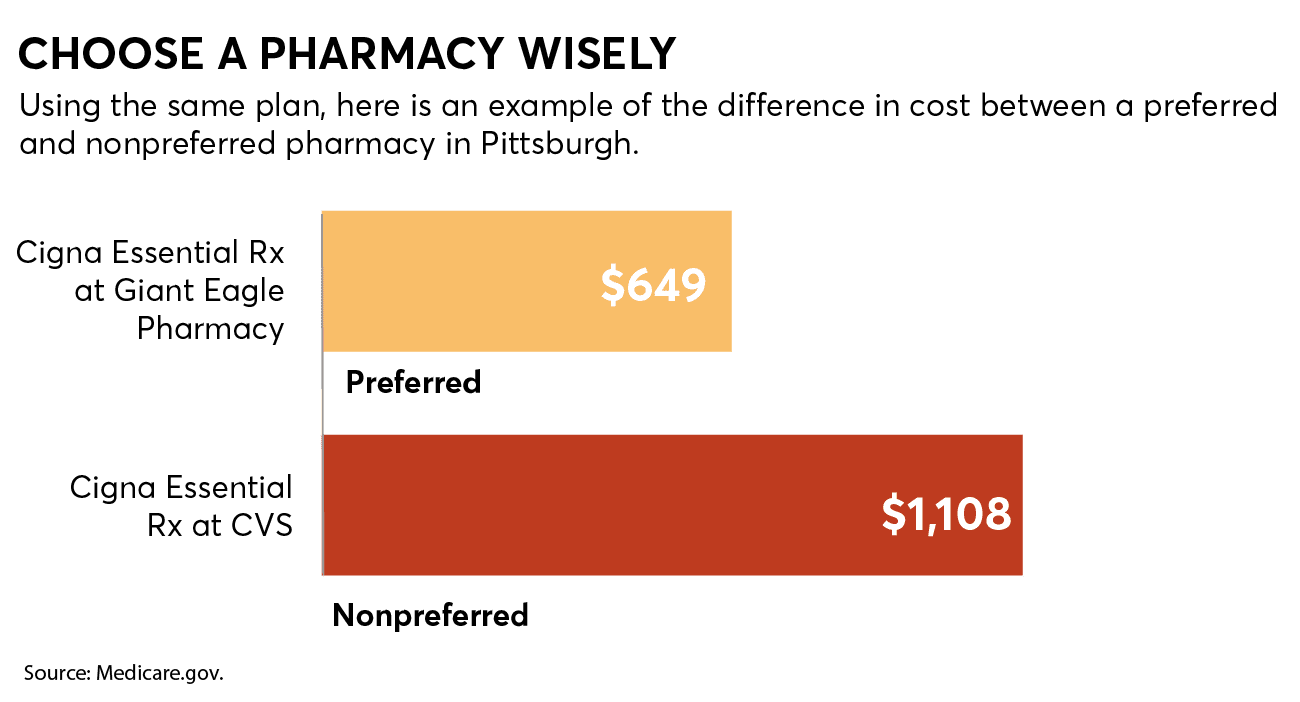

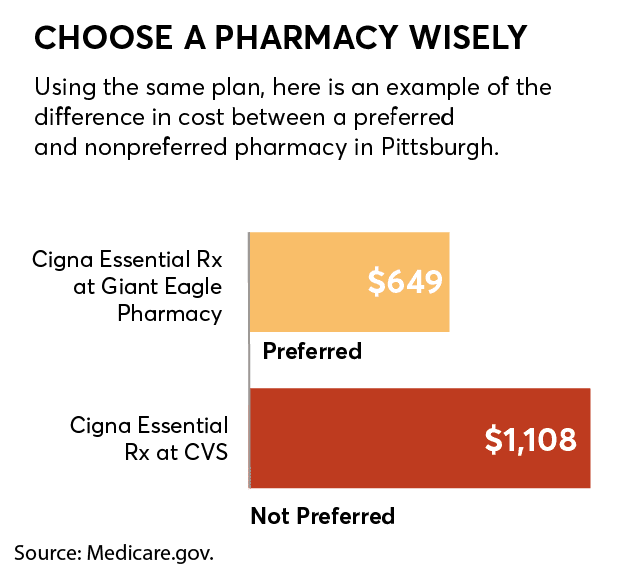

Determining which pharmacies in your area are preferred vs. in-network might be the most confusing part of signing up for a Part D plan, says Stephen Schondelmeyer, PharmD, a professor of pharmacoeconomics at the University of Minnesota in Minneapolis.

When we sorted by “lowest drug + premium cost” using the Medicare plan finder tool, which is the default setting, our spot check found that “preferred pharmacies” might offer some of the lowest prices on generic meds in particular.

Take, for example, two plans in Denver. For our list of medications,with the Humana Walmart Value Rx plan you would spend$463.56 on premiums plus annual drug costs if you filled your prescriptions at Walmart, a preferred pharmacy. But those same drugs at that same pharmacy would cost $1,182 if you signed up for the Wellcare Value Script plan, which doesn’t include Walmart as a preferred pharmacy.

On the other hand, if you did go to one of Wellcare Value Script’s preferred pharmacies, in this case a Safeway, you’d pay $670.80. That’s still more expensive than the Humana Walmart plan using a Walmart pharmacy but a lot less than using a nonpreferred pharmacy.

The problem is that determining which pharmacy in your area is preferred for each Part D plan can be complicated. Here are some tips. First, using Medicare’s plan finder tool, select your usual pharmacy as well as up to four additional ones when prompted, then click “Done.” Next, when the results are displayed, look for pharmacies with the green “Preferred” bar next to them. You can continue to return to the pharmacy section to add or remove stores or search using the map function.

Then look for the pharmacy and Part D plan that have the lowest total amount for both drug and premium costs.

Consider the Doughnut Hole

In Medicare Part D, that’s what you fall into when your annual drug costs (not including premiums) reach $4,660. It’s a gap in coverage that requires you to start shelling out 25 percent of the costfor brand-name or generic drugs. Once your total drug costs reach $7,400, you climb back out of the doughnut hole and pay just 5 percent of the cost of the drug or $3.95 (for a generic) or $9.85 (for a branded medication), whichever is greater.

A person taking the five generics we looked at in our sample comparisons would never spend enough to reach the doughnut hole. But someone who requires more expensive medication easily could. (If this is your situation, you may want to consider checking a Medicare Advantage plan to see if you can lower your costs.)

To find out when you’d hit the doughnut hole, see the “Estimated Total Drug + Premium Cost” section, and then look under “When you’ll enter the coverage gap.” If your costs are high enough, it will list which month you will have spent more than the $4,660 doughnut hole threshold. If you want to stay out of the doughnut hole, look for plans in which the total amount you’d spend on drugs stays below the threshold if possible.

Find Cash Discounts

Sometimes you can save on drugs by paying cash instead of using insurance.

In fact, GoodRx, the drug discount coupon provider, says 34 percent of its customers are people who already have Medicare coverage.

GoodRx isn’t the only game in town for discount cash options. Last year Amazon began selling many prescription drugs in all states except Hawaii, Illinois, Kentucky, Louisiana, and Minnesota. The seller offers some generic drugs—except for controlled substances—with a six-month supply starting at just $6.

Another option: A family-owned company, ScriptCo, launched in 2020, offers all generic medications, including insulin, at wholesale prices after you pay an annual membership fee of $140 or $50 for three months. ScriptCo is licensed in all states except Montana and Tennessee. (ScriptCo doesn’t ship controlled substances.)

Ideally, you want to get all your medications at a single pharmacy, Schondelmeyer says, so that records of everything you’re taking, including vitamins and minerals or herbals, can be kept. “That way, the pharmacist can keep an eye on possible dangerous interactions,” he says.

Get Free Help

A great first source to go to could be your local pharmacist, if you have a favorite, because he or she can tell you which plans they’re the preferred providers for. In addition:

- All states offer free help through the State Health Insurance Assistance Program (877-839-2675).

- Contact Medicare Rights (800-333-4114).

- Call Medicare at 800-633-4227.

Note that if your annual income was below a certain amount in 2021—$20,385 for an individual or $27,465 for a married couple—you may qualify for extra help with drug costs from Medicare.

Editor’s Note: A version of this article also appeared in the December 2022 issue of Consumer Reports magazine.

Lisa L. Gill

Lisa L. Gill is an award-winning investigative reporter. She has been at Consumer Reports since 2008, covering health and food safety—heavy metals in the food supply and foodborne illness—plus healthcare and prescription drug costs, medical debt, and credit scores. Lisa also testified before Congress and the Food and Drug Administration about her work on drug costs and drug safety. She lives in a DIY tiny home, where she gardens during the day and stargazes the Milky Way at night.